- Partners

- Partner Solutions

- Propensity to Buy for Financial Services Customers

Propensity to Buy for Financial Services Customers

Find your top prospects faster and with more accuracy through machine learning

Data-driven insights to drive clear business value

Trust in models built on your organization’s data to deliver reliable results. Our machine learning solution enables your marketing and sales teams to prioritize their attention on those consumers most likely to buy, thus maximizing efficiency.

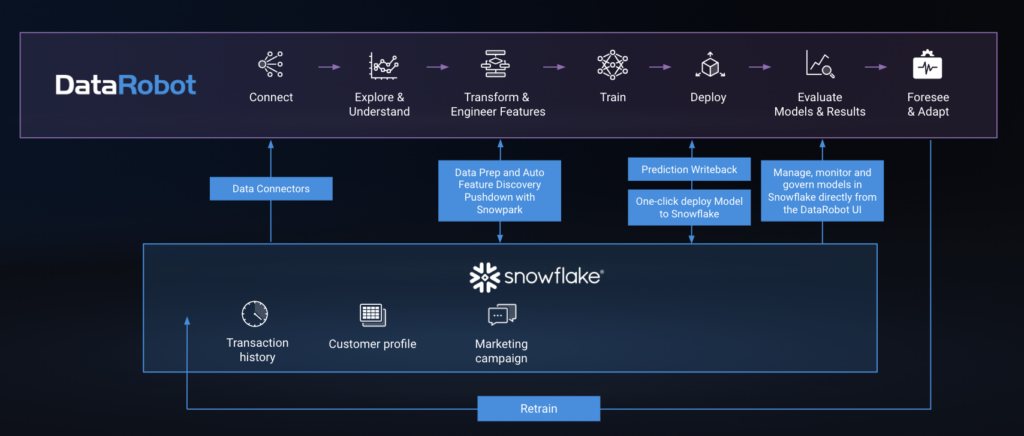

Speed to delivery with DataRobot and Snowflake or other databases

The seamless integration of DataRobot and Snowflake accelerates your end-to-end data and machine learning workflow. Experience results 10x faster than other methods, including data processing, model development, model deployment, data scoring, and ongoing monitoring.

Systematic approach in developing data pipelines and machine learning solutions

Evolutio employs a consistent, repeatable approach for importing your data, creating machine learning models based on that data, and delivering value with the results. This process can work within an organization’s existing systems or can be applied in situations where there is no system in place.

How it Works

Our Propensity to Buy solution leverages targeted marketing data from financial institutions, including credit unions and credit reporting agencies, to increase your marketing return on investment, by identifying consumers most likely to purchase financial products and services.

With this solution, institutions such as banks or credit unions can stack-rank their consumers with a propensity to buy score for each product in their portfolio based on their data profile and past behaviors. Machine learning models pick up patterns from the data and accurately predict future consumer behavior, superseding traditional analytics for population segmentation and filtering.

Evolutio’s data science team develops and deploys propensity to buy models for each product line identified. Leveraging Snowflake into the production workflow enables seamless scheduling and monitoring daily batch predictions through DataRobot, with the prediction results written into Snowflake automatically. For institutions that use other database technologies, Evolutio provides services for different database integrations into DataRobot, for more information see supported databases.

The predicted propensity to buy scores are also delivered to the financial institution’s customer relationship management (CRM) system, with prediction explanations that enable sales teams to prioritize offerings and deliver relevant suggestions to their customers.

Evolutio’s team has worked extensively to maximize value for financial institutions by building an industry suite of models including customer lifetime value, know-your-customer (KYC), and client retention models. These models enable banks, credit unions, and credit agencies to attract, engage, and retain their customers. Additionally, our deep experience partnering with credit agencies amplifies our ability to derive value from data assets.

Key Deliverables

- Complimentary AI Strategy Session to validate data availability and business value of the Use Case

- Expertise in data engineering to extract and combine data from diverse client data sources

- Seamless migration, data pipeline creation, and production deployment

- Optimization of database technology and DataRobot integration capabilities

- Clear analytics insights and actionable guidance on targeted marketing, client satisfaction, and retention

- Results delivered seamlessly into existing technology platforms

About the Partner

Evolutio specializes in helping organizations address the operational challenges of building and scaling complex enterprise applications. The professional service team deploys and optimizes proven technologies to increase revenue, enhance brand loyalty, and provide a premium digital experience.

With extensive industry experience in custom development, data engineering, analytics, machine learning, and MLOps, Evolutio offers proven enterprise project management experience, as well as technical certifications with DataRobot, AWS, GCP, Azure, Snowflake, SAP, Cisco.

Evolutio Data Science services are tailored to accelerate clients’ AI maturity, from first machine learning use case to the implementation of an enterprise AI Center of Excellence. Their expert team supports the full AI lifecycle, including enterprise ML experimentation, deployment and custom application development. Client success stories include Propensity to Buy, Supply Chain Time Series Forecasting, Visual AI, GenAI Solutions, NLP, Employee and Client Retention, and Edge Compute Industrial ML Applications, etc.

Success Story

Top 3 Consumer Credit Reporting Agency

- Achieved a 475% conversion improvement over current analytics methods

- Developed a model with DataRobot in 2 weeks that accurately predicted 80% of US consumers that purchased personal loans over following 3 months

- Expanded models to additional marketing channels, increasing project ROI by another $250K

Large Credit Union with 200K Members across 50 states

- Streamlined customer targeting through production machine learning deployment and DataRobot automation

- Combined multiple datasets from Snowflake, detected and removed indirect target leakage using DataRobot

- Scored all members’ propensity to buy across 12 financial products

- Credit Union reduced costs and increased ROI across Sales and Marketing

- Increased customer satisfaction and higher targeting accuracy through CRM integration allowing tellers to present the most suitable product to members