Ready to Get Started?

Take action now to transform your franchise organization with Ironside's data-driven decision-making solution.

Combining Beacon and DataRobot platform to develop and host your machine learning trading strategies

The joint solution provides customers with access to comprehensive and real-time data from various sources aggregated by Beacon, combing with advanced analytics and machine learning from DataRobot. This enables traders to make informed decisions based on most up-to-date data and accurate machine learning models. By leveraging, customers can identify market trends, predict price movements, and optimize trading strategies, leading to more effective decision-making.

Beacon.io and DataRobot’s joint solution streamlines the data aggregation, model development, testing and deployment process, saving customers valuable time and resources. The automation in the solution allows users to focus on strategy development and decision-making, leads to improved productivity and a competitive edge in the market.

Effective risk management is crucial in commodity trading. DataRobot is able to generate compliance documentation automatically for all the machine learning models.

With this solution, a potential customer is able to leverage both Beacon.io and DataRobot platform to analyze different commodity index and develop machine learning model to forecast the price of desired financial portfolio. For example, a user can leverage oil crack spread, which is the difference between the price of crude oil and the prices of refined products such as heating oil, as features in machine learning models to predict oil price.

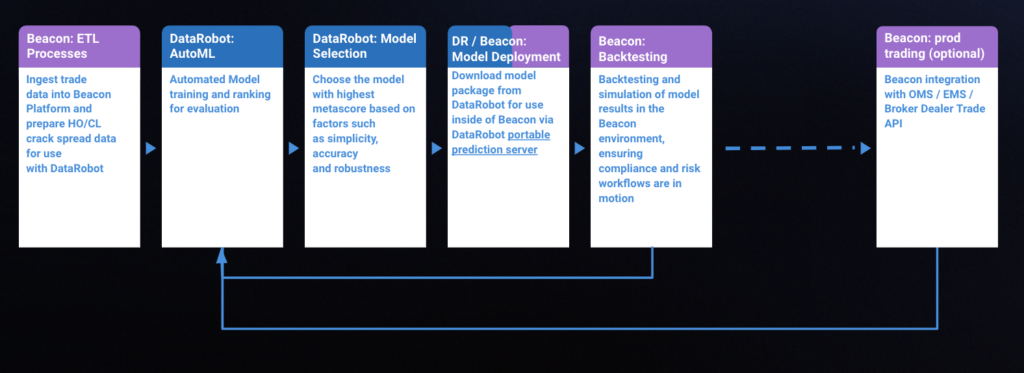

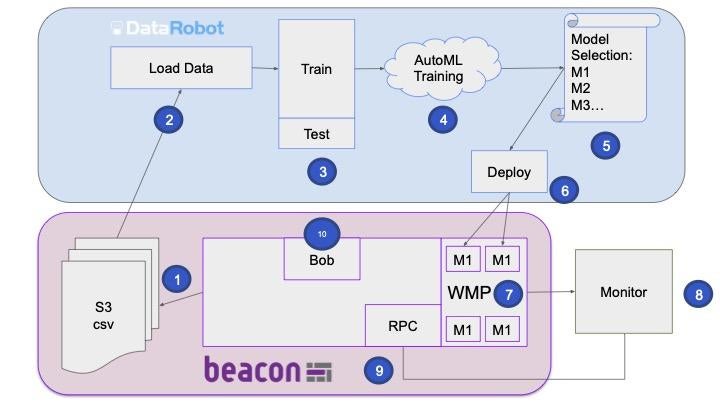

The workflow is illustrated below:

The joint solution combines Beacon.io’s data aggregation capabilities with DataRobot’s machine learning expertise, resulting in a powerful tool for commodity index trading. The process begins with Beacon.io’s platform gathering real-time and historical data related to commodity markets, including supply and demand, weather patterns, geopolitical events, and other relevant factors. This vast dataset is then processed and analyzed by DataRobot’s machine learning algorithms to identify correlations, patterns, and potential market trends.

Traders can leverage the joint solution to develop and test various trading strategies based on the insights generated by the data analysis. DataRobot’s platform enables users to build predictive models that can forecast commodity price movements, assess risk factors, and optimize portfolio allocation. These models can be continuously refined and adjusted based on real-time market data, ensuring that trading strategies remain up-to-date and adaptive to changing market conditions.

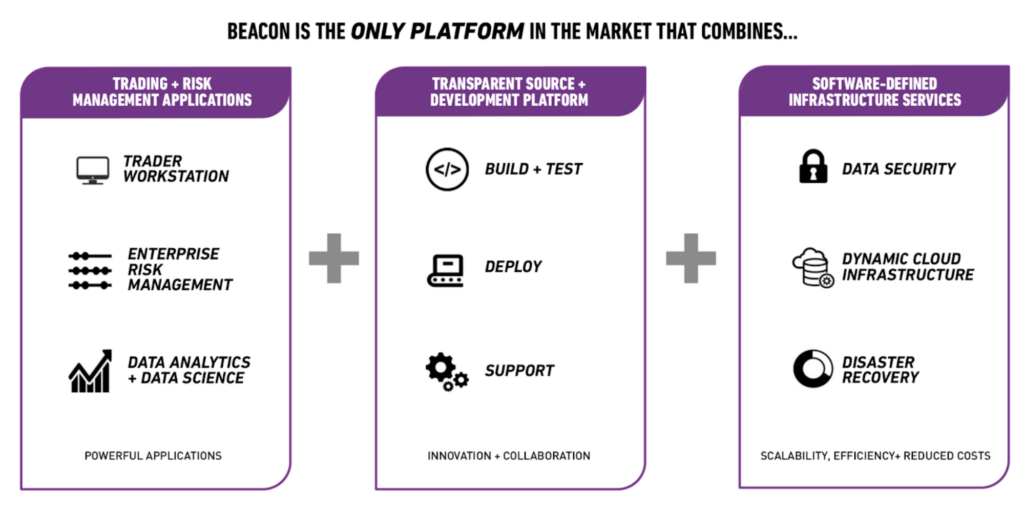

Beacon.io is a leading platform provides risk analytics and quantitative research capabilities for financial institutions to make informed trading and risk management decisions based on data analytics. The platform provides secure and scalable infrastructure, flexible and extensible data model, as well as capabilities to develop trading and risk management applications with data analytics and machine learning capability through DataRobot.

A top global derivatives marketplace: The integration with Beacon reduces complexity and make it easier for customers to consume their market data. Seamless analytics-based solutions are delivered to help their customers to make informed trading and risk management decisions.