Colin Priest is a Fellow of the Institute of Actuaries of Australia and has worked in a wide range of actuarial and insurance roles, including Appointed Actuary, pricing, reserving, risk management, product design, underwriting, reinsurance, relationship management, and marketing. Over his career, Colin has held a number of CEO and general management roles, where he has championed data science initiatives in financial services, healthcare, security, oil and gas, government and marketing. He frequently speaks at various global actuarial conferences.

Colin is a firm believer in data-based decision making and applying machine learning to the insurance industry. He is passionate about the science of healthcare and does pro-bono work to support cancer research.

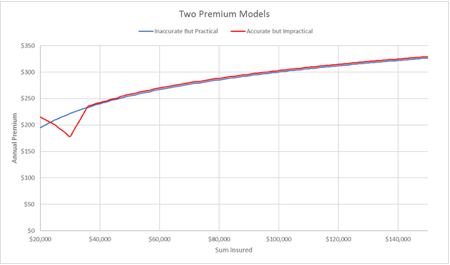

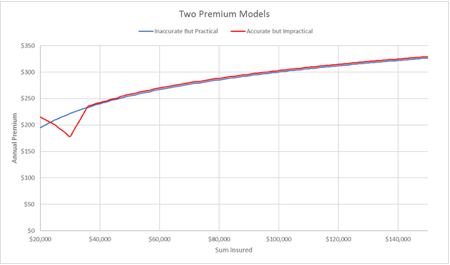

The great artist Pablo Picasso once said “Computers are useless. They only give you the answers.” Similarly, insurance executives have been known to make jokes such as “You must be an actuary. You gave us information that is accurate, but completely useless”. How can information be accurate, yet useless? The answer lies in whether information allows for the practicalities of a business: business strategy and goals, business rules and stakeholder reactions. Insurance pricing models must avoid the trap of being accurate, yet useless.

Pablo Picasso, 1913-14, L’Homme aux cartes (Card Player), oil on canvas, 108 x 89.5 cm, Museum of Modern Art, New York.

Insurance rate setting isn’t just about technical pricing analysis. While actuaries have a long established role estimating claims costs, in recent years they have had a developing role in commercial pricing decisions. Actuaries, working with insurance pricing executives, have increasingly developed pricing models that address broader business objectives, such as premium rates that:

- Are competitive

- Are profitable

- Discourage fraudulent and risk-seeking behavior

None of these three goals should be surprising to actuaries, as these principles are part of the core actuarial education syllabus. Insurance premiums must be competitive to ensure sufficient volumes of business can be sold, enough to cover fixed costs and premium rates must also be competitive to avoid reputational risk. For example, if an insurer’s rates are too high for selected risks, they may develop a reputation as super-expensive on all rates, and that could affect their ability to write other risks.

Finally, premium rates should not encourage the wrong behavior in customers. For example, several years ago a junior actuarial analyst proudly showed me his recommended premium rates for household contents insurance. He was excited that he had fitted a statistical model that more accurately explained historical claims. The problem was that he had recommended lower prices for higher coverage limits! His analysis had accurately predicted that policyholders taking the minimum allowed coverage were worse risks than those who voluntarily chose higher limits to cover their household items. If we charged his recommended premium rates, these bad risk policyholders could reduce their premiums by purchasing more cover. This would make their claims costs even higher while simultaneously charging lower premiums!

All of the above are examples of business rules that insurance premium models are expected to satisfy. Let’s consider three business rules that are common in auto/motor pricing around the world. Pricing actuaries will probably be familiar these rules:

- Exposure-to-Risk: The cost of claims should be proportional to the length of time that the insurance contract was active. For example, insurance contracts that started a month ago will on average have only one-twelfth the number of claims versus insurance contracts that started a year ago, all other things being equal. This is shown in the diagram above.

- Policy Cancellation Refunds: It is often the case that a policyholder can cancel their policy part way through the contract period, and receive a pro-rata premium refund. When these rules apply, an insurance premium should be earned/accrued pro-rata across the full policy period. This is shown by Policy D in the diagram above.

- No Claim Discount: In many parts of the world auto/motor insurance policy wordings include contractual premium discounts based upon the number of claim-free years a policyholder has achieved prior to the commencement of the latest insurance contract.

When actuaries began to use generalized linear models (GLMs) for pricing analysis, they addressed these three business rules by adjusting GLM formula to include “exposures” and “offsets”. Exposures are used to linearly scale the predicted value, and they address the issues of exposed-to-risk and policy cancellation business rules. Offsets set some of the model coefficients to manually defined values, which can be used to address other business rules, such as no claim discounts.

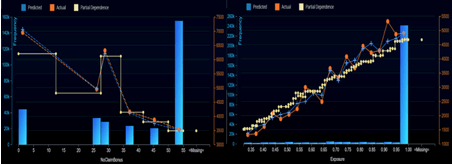

With the move to more modern machine learning algorithms, actuaries are achieving greater accuracy in premium modeling. But not all machine learning algorithms and libraries support exposures and offsets. As the screenshots above show, unless you are careful, machine learning models will fit the most accurate patterns to data, without regard to your business rules (note: the exposure pattern must be pro-rata and the NCD relativities must match the contractual discount percentages). Some actuaries have created workarounds, using exposures as an input to the machine learning models. Others have followed a two-stage process, adjusting the data for offsets, then using a model to predict the residuals from the first stage. These hacks are neither elegant nor efficient.

Wouldn’t it be great if your machine learning software was smart enough to know which algorithms support exposures and offsets and which don’t? Wouldn’t it be great if your machine learning software included extensions to popular libraries to add exposures and offset capabilities to those libraries? DataRobot makes this easy for you. Once you include exposure and offsets in your project settings, DataRobot automatically selects only those algorithms and libraries that support exposure and offsets. Now, with one-click of a button you can have accuracy and practicality, with proper allowance for business rules.

About the author

Colin Priest

VP, AI Strategy, DataRobot

Colin Priest is the VP of AI Strategy for DataRobot, where he advises businesses on how to build business cases and successfully manage data science projects. Colin has held a number of CEO and general management roles, where he has championed data science initiatives in financial services, healthcare, security, oil and gas, government and marketing. Colin is a firm believer in data-based decision making and applying automation to improve customer experience. He is passionate about the science of healthcare and does pro-bono work to support cancer research.

Pablo Picasso, 1913-14, L’Homme aux cartes (Card Player), oil on canvas, 108 x 89.5 cm, Museum of Modern Art, New York.

Pablo Picasso, 1913-14, L’Homme aux cartes (Card Player), oil on canvas, 108 x 89.5 cm, Museum of Modern Art, New York.